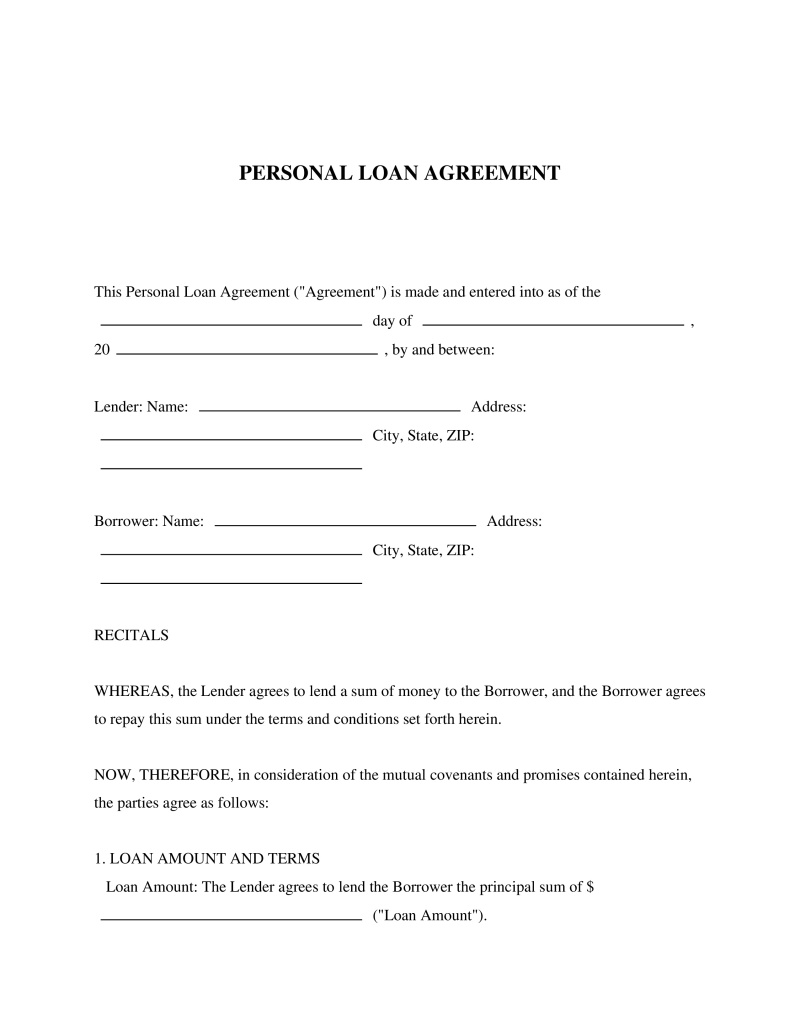

A Personal Loan Agreement is a legal document that outlines the terms of a loan between individuals or businesses, including repayment, interest, and collateral, to ensure clarity and protect both parties involved.

Borrower Full Name

Please provide the full legal name.

Table of Contents

What is a Personal Loan Agreement?

A Personal Loan Agreement is a legally binding document that outlines the terms and conditions under which one party (the lender) lends a certain amount of money to another party (the borrower). This document is crucial for both parties as it clearly defines the loan amount, interest rate, repayment schedule, and any other terms specific to the loan. Individuals or entities might require this template to ensure that the terms of the loan are clearly understood and agreed upon by both parties, thereby minimizing misunderstandings and legal disputes down the line. Whether you're lending to or borrowing from a friend, family member, or business associate, this template can provide a solid foundation for your financial transaction.

Key Features

Important Provisions

- Payment Terms: Clearly outlines how much is being borrowed, the interest rate applied, repayment schedule, and method of payment.

- Late Payment Penalties: Specifies penalties or additional interest for late payments, providing incentive for timely repayment.

- Prepayment: Addresses whether you can pay off a personal loan early and under what conditions, including any penalties or fee waivers.

- Default Provisions: Details consequences if the borrower fails to make payments or otherwise defaults on the loan terms.

- Governing Law: Identifies which state's laws will govern the interpretation and enforcement of the agreement.

Pros and Cons

Pros

- +Provides a clear, comprehensive outline of the loan's terms and conditions, reducing potential misunderstandings between parties.

- +Legally enforceable document that offers protection to both lender and borrower by specifying recourse in case of disputes.

- +Flexibility in customizing terms such as repayment schedules and interest rates to suit individual agreements.

- +Potentially saves time and legal expenses by including necessary clauses and provisions tailored to personal loans.

- +Facilitates a smoother lending process by clarifying obligations and expectations from the outset.

Cons

- -Requires thorough review and possibly legal consultation to ensure all personal circumstances are adequately addressed.

- -May not cover all legal requirements or consumer protections required in certain jurisdictions without modification.

- -Some borrowers or lenders may find the formal nature of a written agreement intimidating or off-putting.

Common Uses

- Lending money to friends or family members with clear terms to avoid misunderstandings.

- Borrowing funds from an individual rather than a bank or traditional financial institution.

- Creating a record of a loan for tax purposes or financial planning.

- Facilitating peer-to-peer lending transactions securely and professionally.

- Establishing terms for employee loans provided by employers as part of benefit packages.

- Documenting loans with interest payments between individuals for investment purposes.

Frequently Asked Questions

Do you have a question about a Personal Loan Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!