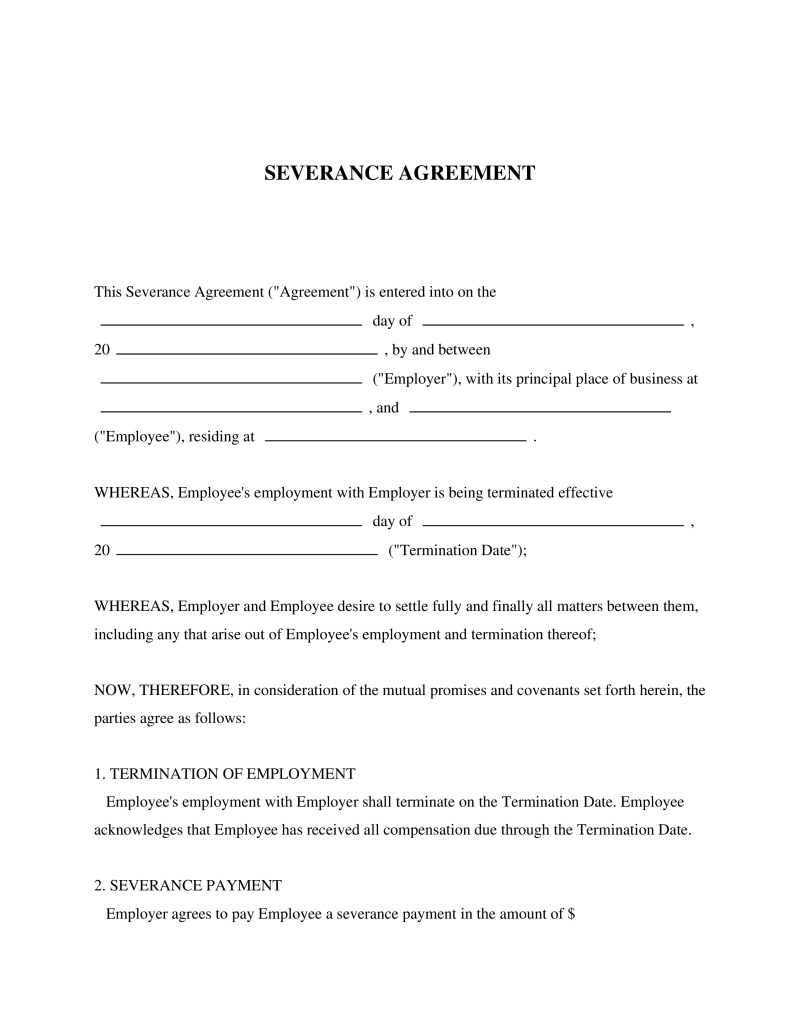

A Severance Agreement is a contract between an employer and employee outlining terms of separation, including compensation and conditions.

Employer Name

Type the full legal name of your employer in this field. This should include any business designations like "Inc." or "LLC" if applicable. Accurate information is important as it may affect your rights and obligations in any legal matters related to your employment.

Table of Contents

What is a Severance Agreement?

A Severance Agreement is a legal document that outlines the terms under which an employee will be separated from their employer, including any severance package or severance pay to be provided. This document serves to protect both parties by clarifying expectations and responsibilities, reducing the likelihood of future disputes. It is crucial for employers who wish to ensure a smooth transition during layoffs or terminations, and for employees who seek to understand their rights and benefits upon departure. Severance Agreements often include conditions such as non-disclosure and non-disparagement clauses, making them essential in maintaining confidentiality and safeguarding the company's reputation.

Key Features

Important Provisions

- Severance Pay Clause: Details how much, how often, and under what conditions severance will be paid.

- Confidentiality Agreement: Requires the departing employee to keep proprietary information private.

- Non-Disparagement Clause: Prevents the employee from making negative statements about the employer post-departure.

- Release of Claims: The employee agrees not to sue the employer for issues related to their employment or termination.

Pros and Cons

Pros

- +Offers financial support to employees during their transition period after employment ends.

- +Reduces the risk of legal disputes by clearly defining terms of separation.

- +Enhances the employer's reputation by demonstrating care for employee welfare even after termination.

- +Protects confidential information and company interests through enforceable clauses.

- +Facilitates negotiations between the employer and employee regarding exit terms.

Cons

- -Negotiating a fair severance agreement can be time-consuming and potentially require legal assistance.

- -Severance payments may represent a significant financial burden for small businesses.

- -Certain provisions, such as non-compete clauses, might be seen as restrictive from an employee’s perspective.

Common Uses

- In situations where an employee is being laid off due to company downsizing or restructuring.

- When an employee is terminated without cause and is offered compensation in return for certain concessions.

- To resolve employment disputes or potential litigation in a manner that is amicable to both parties.

- As part of a negotiated exit strategy for high-level executives or long-term employees.

- When updating terms of separation in line with new company policies or legal requirements.

Frequently Asked Questions

Do you have a question about a Severance Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!