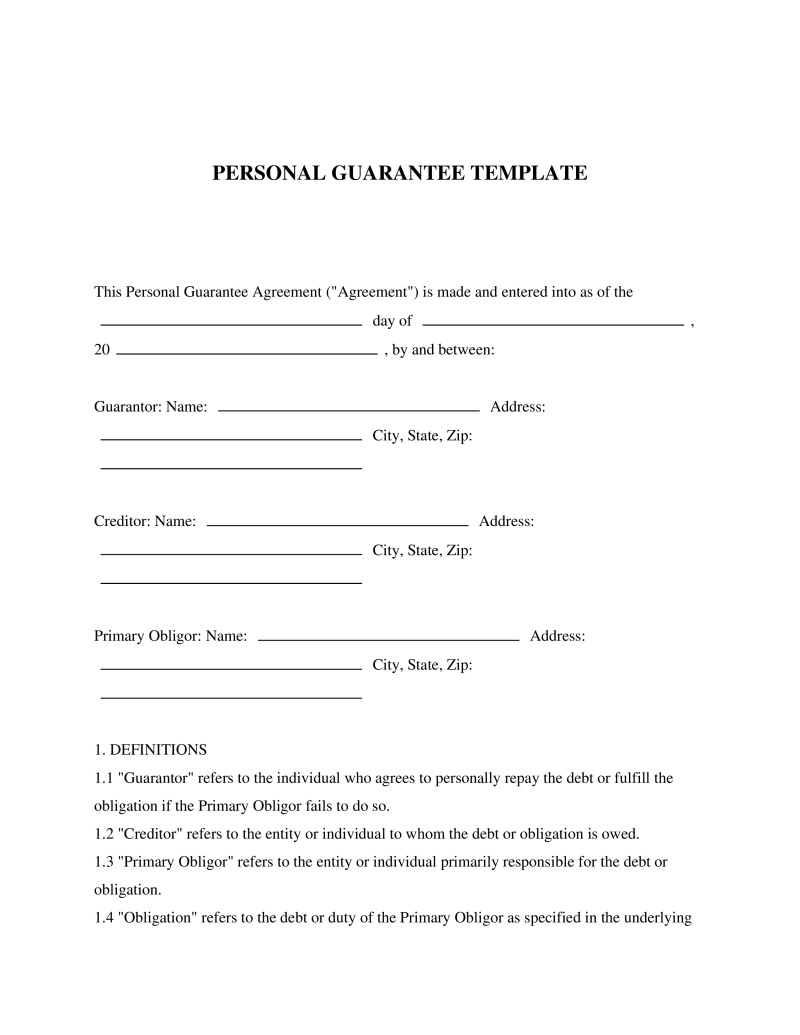

A Personal Guarantee is a legal document where an individual agrees to be responsible for another's debt or obligation if they default.

Guarantor Name

Write the full legal name of the Guarantor, who is the person agreeing to take responsibility for the obligations in this document. Use their first name, middle initial (if applicable), and last name, such as "John A. Smith." This name will be used in legal agreements, so it must be accurate and match official identification.

Table of Contents

What is a Personal Guarantee?

A Personal Guarantee is a legal commitment made by an individual (the guarantor) to accept responsibility for fulfilling another party's financial obligation if that party fails to do so. This form of assurance is particularly vital in situations where the primary party seeking a loan or entering into a lease lacks sufficient credit history or assets to satisfy the lender or landlord. By involving a personal guarantor, lenders and lessors are provided an additional layer of security, making them more inclined to extend credit or lease agreements. Individuals or businesses looking to borrow funds, secure leases, or enter contracts where financial trustworthiness needs bolstering will find this document indispensable. Essentially, it enables transactions that might otherwise be deemed too risky by providing a promise that the debt will be paid.

Key Features

Important Provisions

- Identification of Parties: Clearly delineates who is involved as creditor, debtor, and guarantor.

- Obligation Details: Specifies what obligations are guaranteed and any limits on those obligations (e.g., capped amounts).

- Conditions Precedent: Outlines any conditions that must occur before the guarantee becomes effective (e.g., debtor default).

- Guarantee Term: States how long the guarantee remains in effect and under what circumstances it can be terminated or renewed.

- Remedies on Default: Details remedies available to creditors if obligations are not met, including steps for notification and settlement.

Pros and Cons

Pros

- +Enhances borrower’s ability to obtain loans or lease agreements by providing lenders and lessors with increased security.

- +Offers flexibility in financial dealings, allowing businesses and individuals with less established credit histories to engage in transactions.

- +Potentially negotiates better terms or lower interest rates due to the reduced risk presented by the presence of a guarantor.

- +Assures creditors of repayment, thereby facilitating smoother business operations and relationships.

- +Provides a clear legal framework that protects all parties’ interests through well-defined terms and conditions.

Cons

- -Places significant financial risk on the personal guarantor who must repay the obligation if the primary debtor defaults.

- -Could potentially strain personal relationships if the guarantee is called upon due to financial difficulties of the debtor.

- -May not fully absolve the primary debtor from scrutiny as creditors might still require substantial evidence of their ability to initially meet obligations.

Common Uses

- Securing business loans when a company lacks sufficient collateral or credit history.

- Facilitating rental agreements for commercial or residential properties, especially for new entities without prior leasing records.

- Obtaining lines of credit for startup businesses requiring capital but lacking extensive financial records.

- Enabling students or young adults to sign lease agreements for housing when they have no credit history.

- Backing up service contracts where large sums of money are involved and there is a need for assurance beyond corporate guarantees.

Frequently Asked Questions

Do you have a question about a Personal Guarantee?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!