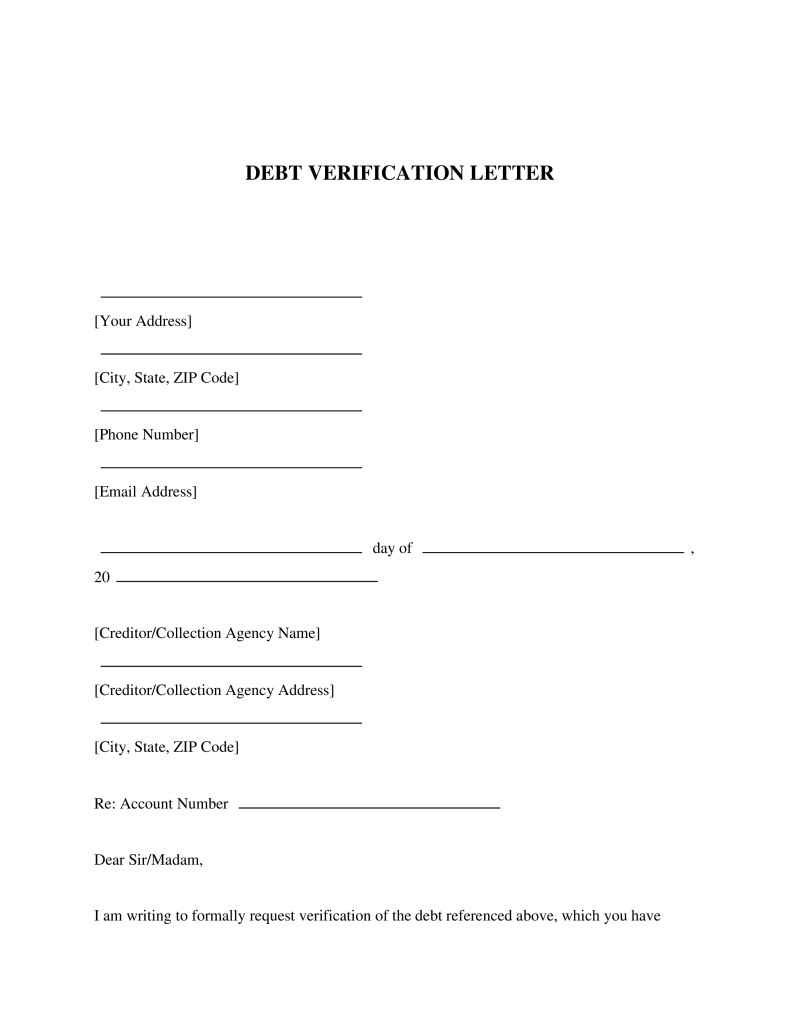

A Debt Verification Letter is a document requesting proof of debt from a creditor, ensuring accuracy and validating financial obligations.

Debtor Name

Write your full legal name as it appears on official documents, such as your driver's license or passport. This includes your first name, middle name (if any), and last name, without any nicknames. Providing your correct legal name is important because it ensures accuracy in legal records and documents.

Table of Contents

What is a Debt Verification Letter?

A Debt Verification Letter is a legal document that consumers can use to request confirmation or verification of a debt from a debt collection agency. This document is typically used when a consumer is unsure about the details or validity of a debt that has been assigned to them. The letter template allows consumers to formally request that the collection agency provide proof and details about the debt, such as the original contract or detailed statement of the account.

Key Features

Pros & Cons

Pros

Cons

Common Uses

FAQs

Do you have a question about a Debt Verification Letter?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!