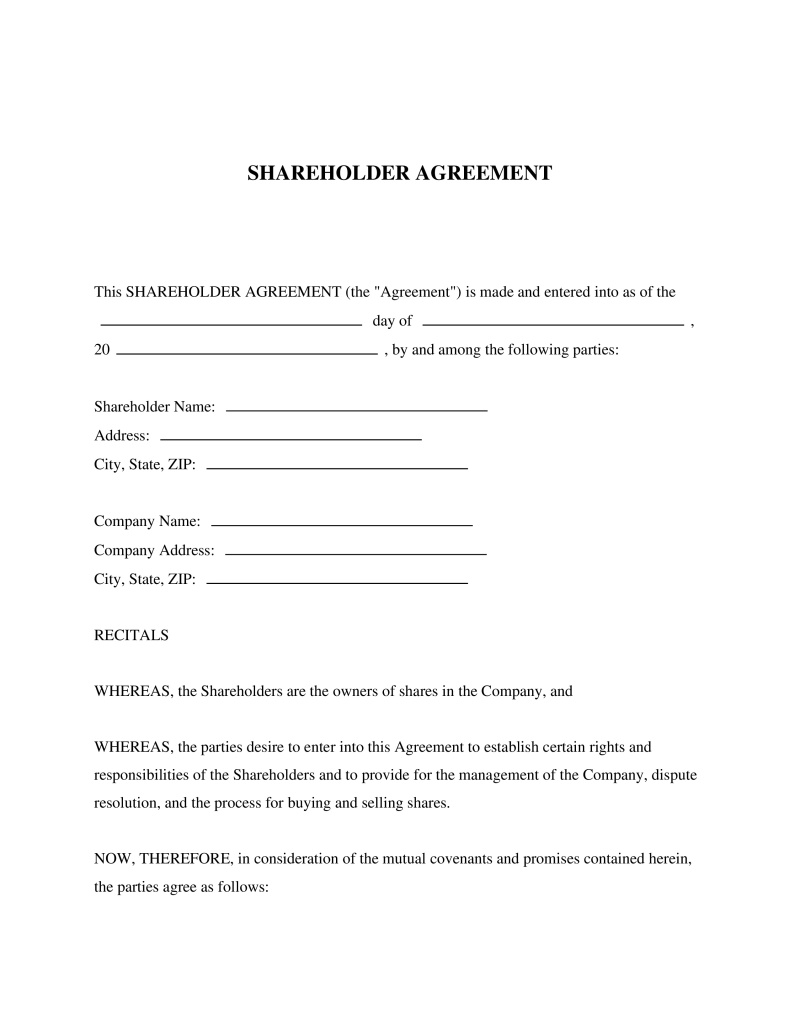

A Shareholder Agreement outlines the rights, responsibilities, and obligations of shareholders in a corporation, ensuring clarity and preventing disputes.

Company Name

Type the full legal name of the company as it appears in official documents, such as registration papers or tax filings. Make sure to include any suffixes like "Inc.", "LLC", or "Corp." if applicable. This name is important for legal identification and will be used in all official correspondence and contracts.

Table of Contents

What is a Shareholder Agreement?

A Shareholder Agreement, often referred to as a shareholder contract, is a formal document that outlines the rights, responsibilities, and obligations of individuals or entities holding shares in a company. Its primary purpose is to govern the relationship between shareholders themselves and their relationship with the corporation, ensuring clarity and fairness in business operations. This agreement becomes crucial for privately held companies where shareholder disputes might arise or when establishing clear protocols for the sale and transfer of shares. It serves to protect shareholders' investments, dictate how decisions are made, and manage how shares can be bought or sold. Anyone with equity in a company, from startup founders to investors in family businesses, needs this document to safeguard their interests and maintain business harmony.

Key Features

Important Provisions

- "Drag-Along" and "Tag-Along" rights, which allow majority shareholders to force minority shareholders to join in the sale of a company, and vice versa.

- "Shotgun" clause that enables a shareholder to offer their shares at a specific price either to be bought out or buy out another shareholder's shares at that price.

- "Right of First Refusal" clauses giving existing shareholders the right to match any offer for shares made by an outsider.

- "Non-compete" clauses preventing shareholders from starting or investing in competing businesses within a certain timeframe.

Pros and Cons

Pros

- +Mitigates potential conflicts between shareholders by clearly defining roles and expectations.

- +Facilitates smoother operational management by outlining decision-making processes.

- +Protects minority shareholders from being unfairly outvoted or overlooked.

- +Enhances stability within the company by setting clear rules for share transfers.

- +Improves investor confidence by demonstrating a commitment to transparency and fairness.

Cons

- -May require time and resources to negotiate terms acceptable to all parties involved.

- -Could potentially limit a shareholder's ability to freely sell or transfer shares.

- -Needs regular updates to reflect changes within the company or its ownership structure.

Common Uses

- Establishing the foundations of a startup with multiple investors.

- Regulating the entry of new shareholders into an existing business.

- Creating mechanisms for resolving disputes without resorting to legal action.

- Planning for succession or exit strategies for retiring shareholders.

- Protecting proprietary information and intellectual property rights within a partnership.

- Facilitating the transfer of shares under specific conditions such as death or termination of employment.

Frequently Asked Questions

Do you have a question about a Shareholder Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!