A Separation Agreement is a legal document outlining terms for spouses who decide to live apart, covering issues like asset division and support.

Separation Type

Select the scenario that best describes your situation. This helps tailor the agreement to your needs.

Table of Contents

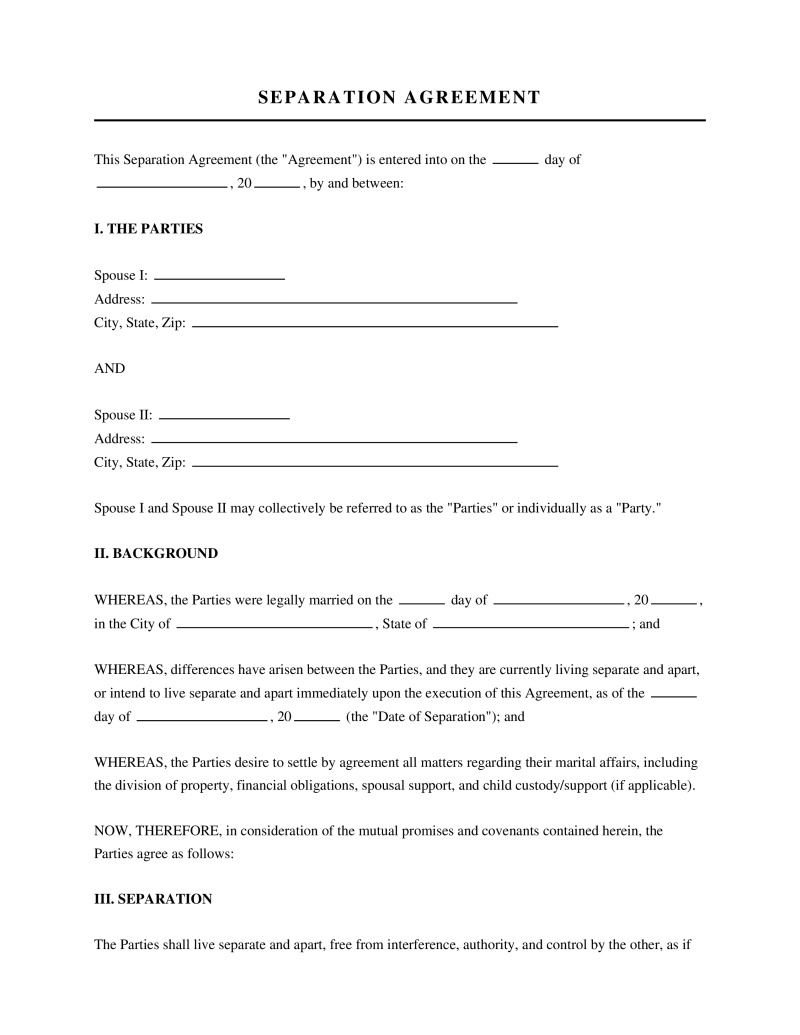

What is a Separation Agreement?

A separation agreement is a legally binding contract executed between spouses or domestic partners who elect to live apart while remaining legally married. This document comprehensively outlines the rights and responsibilities of each party regarding financial assets, debts, child custody, and support obligations during the period of separation. Couples utilize this instrument to establish clear boundaries and logistical frameworks without officially dissolving the marriage through divorce. The terms established within this contract often serve as the foundation for a final divorce decree should the parties decide to permanently end the relationship.

Types of Separation Arrangements

Couples may choose different forms of separation based on their specific marital goals and legal needs. The specific terminology and legal recognition vary by jurisdiction.

- Trial Separation - Involves a temporary period of living apart to evaluate the viability of the marriage while adhering to informal or written rules regarding finances and parenting.

- Permanent Separation - Occurs when spouses have no intention of reconciling but choose not to divorce for religious, financial, or insurance reasons.

- Legal Separation - Refers to a court-ordered status where a judge issues a decree defining the rights and duties of the couple while leaving the marriage bond intact.

- Separation by Agreement - Establishes a private contract between spouses settling all marital issues without court intervention unless enforcement is required.

Key Components of the Document

A comprehensive separation agreement addresses various aspects of the marital estate and family dynamic. Drafting a thorough document reduces the likelihood of future litigation.

- Property and Asset Division - Identifies and distributes marital property, including real estate, bank accounts, vehicles, and personal possessions.

- Debt Allocation - Assigns responsibility for outstanding liabilities such as mortgages, credit card balances, and personal loans to specific parties.

- Spousal Maintenance - Determines the amount, duration, and method of alimony payments if one spouse requires financial support.

- Child Custody and Visitation - Establishes legal and physical custody arrangements alongside a detailed parenting schedule.

- Child Support - Calculates financial contributions for the upbringing of children in accordance with state guidelines.

- Insurance Continuation - Clarifies who maintains health, life, and dental insurance policies during the separation period.

Legal Validity and Enforceability

Courts scrutinize separation agreements to ensure fairness and adherence to procedural standards. Specific elements must exist for the contract to hold weight in legal proceedings.

- Full Financial Disclosure - Parties must provide a complete and accurate inventory of all assets and liabilities to prevent claims of fraud.

- Voluntary Execution - Signatures must be obtained without coercion, duress, or undue influence from either party.

- Fair and Reasonable Terms - Provisions regarding property and support must not be unconscionable or heavily skewed against one spouse.

- Independent Legal Counsel - Many jurisdictions prefer or require that each party has the opportunity to review the document with their own attorney.

- Notarization - Signatures typically require witnessing by a notary public to authenticate the execution of the document.

Federal and State Laws

Various statutes govern the drafting, tax implications, and enforcement of separation agreements. These laws ensure the protection of dependents and the equitable distribution of resources.

- Uniform Marriage and Divorce Act - Provides model legislation adopted by several states regarding the enforcement and modification of separation agreements (UMDA § 302).

- Internal Revenue Code Alimony Rules - Governs the tax deductibility and income inclusion of spousal support payments for agreements executed before or after specific dates (26 U.S.C. § 71).

- Employee Retirement Income Security Act - Regulates the division of qualified pension and retirement plans through Qualified Domestic Relations Orders (29 U.S.C. § 1056).

- Full Faith and Credit Clause - Mandates that states recognize valid legal judgments and decrees, including legal separations, issued by other states (U.S. Const. art. IV, § 1).

- Uniform Interstate Family Support Act - Establishes rules for enforcing child support orders across state lines when parents live in different jurisdictions (UIFSA 2008).

Separation Agreement vs. Divorce Decree

Distinguishing between separation and divorce is essential for understanding long-term legal status. A separation agreement functions as a contract between married persons, whereas a divorce decree is a court judgment terminating the marriage.

- Marital Status - Parties remain legally married under a separation agreement, preventing remarriage until a formal divorce occurs.

- Inheritance Rights - State laws may preserve inheritance rights during separation unless specific waivers are included, unlike divorce which automatically revokes spousal bequests.

- Health Insurance - Non-employee spouses can often remain on employer-sponsored health plans during separation, a benefit usually lost upon divorce.

- Tax Filing Status - Separated couples may still file taxes jointly or as "married filing separately" unless a court issues a decree of separate maintenance.

How to Execute a Separation Agreement

A separation agreement is a legally binding contract between spouses that outlines the terms of their separation. The execution process requires careful attention to ensure the document is enforceable in your jurisdiction.

Before You Begin: Understand Your State's Requirements

Separation agreement requirements vary significantly by state. Some states, including Delaware, Florida, Georgia, Mississippi, Pennsylvania, and Texas, do not recognize legal separation as a formal status. In these states, a separation agreement may still be valid as a private contract but cannot be filed with the court for legal separation status. Check whether your state recognizes legal separation and what specific formalities apply.

Step 1: Gather Complete Financial Documentation

Compile comprehensive records of all marital assets, debts, and income sources. This includes:

- Real estate deeds and mortgage statements

- Bank, retirement, and investment account statements

- Tax returns from the past three to five years

- Life, health, and property insurance policies

- Vehicle titles and loan documents

- Business ownership documents and valuations

- Credit card statements and other debt records

Full financial disclosure is essential. Many states require formal disclosure, and courts may invalidate agreements where one party concealed assets.

Step 2: Negotiate the Terms

Work through all issues that need resolution, including property and debt division, spousal support or alimony, child custody and parenting time, child support calculations, health insurance continuation, and retirement account division.

Consider engaging a mediator for complex negotiations. Some states require mediation before court involvement in custody matters. Each party may also consult separately with attorneys during this phase.

Step 3: Draft the Agreement

Convert negotiated terms into a formal written document. The agreement should use clear, unambiguous language and address all relevant issues comprehensively. Include specific dollar amounts, dates, and deadlines rather than vague terms. Many states require specific provisions for child support calculations based on state guidelines.

Step 4: Independent Legal Review

Each party should have the agreement reviewed by separate legal counsel. This step serves several purposes: it ensures each party understands their rights and obligations, it demonstrates that both parties entered the agreement voluntarily and with full knowledge, and it reduces the likelihood of future challenges to the agreement's validity.

While not legally required in most states, independent review significantly strengthens enforceability.

Step 5: Execute the Agreement with Proper Formalities

Signing requirements vary by state:

Notarization: Most states require notarization for the agreement to be enforceable, particularly for provisions affecting real property. Some states require notarization for court filing. Even where not required, notarization adds an extra layer of authentication.

Witnesses: Some states require one or two witnesses in addition to or instead of notarization. Check your state's specific requirements.

Signatures: Both parties must sign the agreement. Ensure signatures match legal names exactly as they appear elsewhere in the document.

Step 6: Court Filing (If Applicable)

Whether to file with the court depends on your state and goals:

States with formal legal separation: Filing may be required to obtain legal separation status and court enforcement powers.

Incorporation into divorce: In many states, the separation agreement can later be incorporated into a divorce decree, making its terms enforceable as a court order.

Recording requirements: Provisions affecting real property may need to be recorded with the county recorder's office.

Child-related provisions: Some states require court approval of custody and support terms to ensure they meet the children's best interests.

FAQs

Do you have a question about a Separation Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!