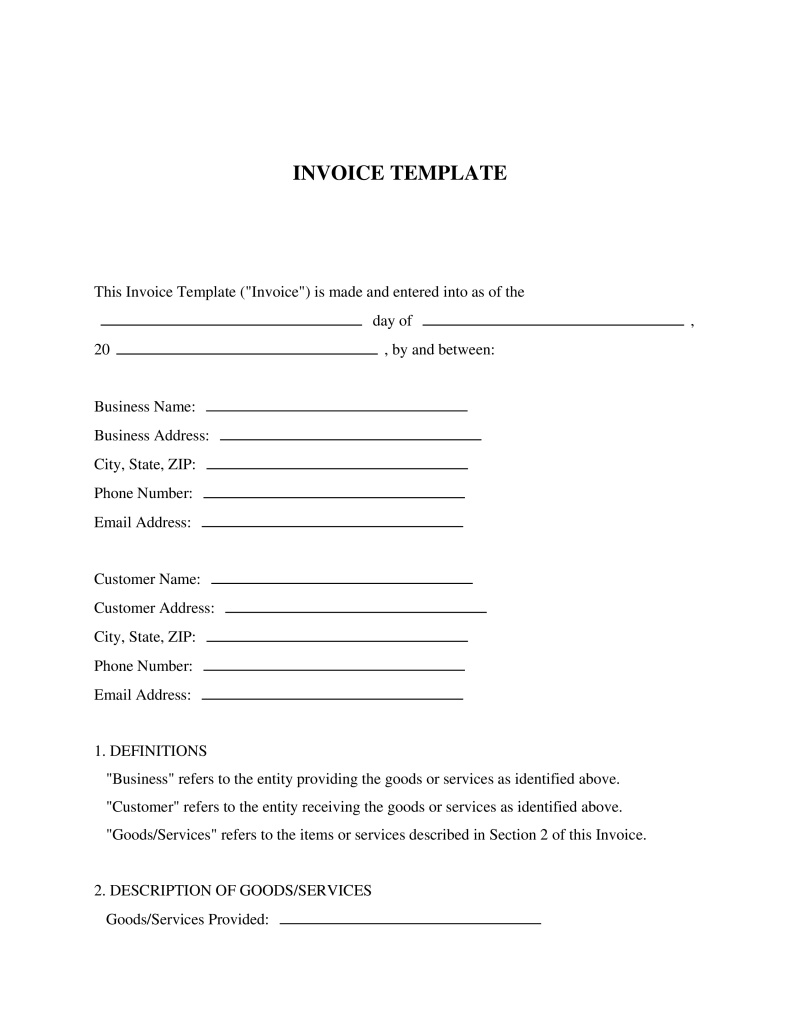

Invoice Template

Business Name

Type the official name of your business as it appears on legal documents or registration papers. Make sure to include any suffixes like "Inc." or "LLC" if applicable. Providing the correct name is important because it ensures your business is properly identified in legal matters.

Not the form you're looking for?

Try our AI document generator to create a custom document

Powered by AI • Create custom legal documents instantly

What is an Invoice Template?

An Invoice Template serves as a critical tool for businesses and freelancers alike, facilitating the billing process by providing a structured format for requesting payments for goods or services rendered. This document not only specifies the amount due but also outlines the terms of payment, ensuring clarity and preventing potential disputes between parties involved. By utilizing a free invoice template, individuals and companies can streamline their billing processes, maintaining professionalism and efficiency. Whether you're a small business owner seeking to formalize your payment requests or a freelancer aiming to simplify your financial administration, understanding how to make an invoice using a template can save time and reduce errors, making it an indispensable part of financial transactions.

Key Features

Important Provisions

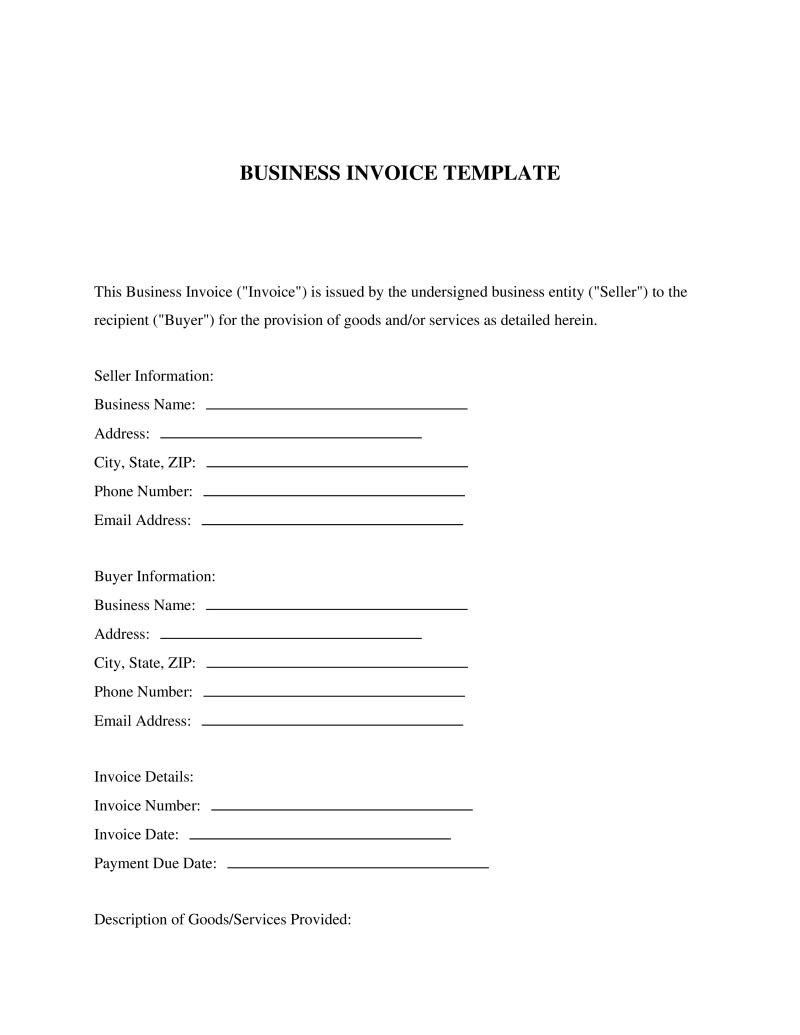

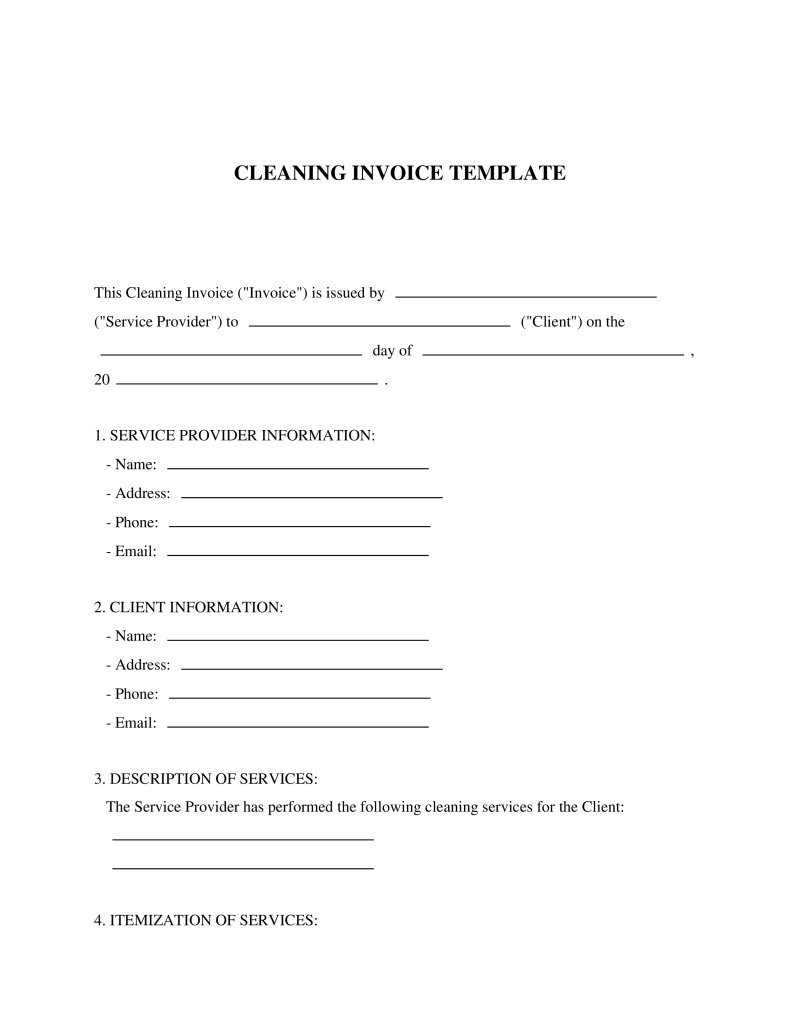

- Details of Goods/Services: A comprehensive description of what is being charged for, including quantities and unit prices where applicable.

- Payment Terms: Clearly defined conditions under which payment is expected, including any late fees or interest charges on overdue amounts.

- Contact Information: Both provider's and recipient's contact details to facilitate communication regarding the invoice if necessary.

- Legal Clauses: Any applicable legal requirements or clauses related to taxation, confidentiality agreements, or dispute resolution mechanisms.

Pros and Cons

Pros

- +Enhances organizational efficiency by providing a clear, standardized format for billing.

- +Reduces the likelihood of errors through predefined sections that prompt for all necessary information.

- +Saves time by eliminating the need to create new invoices from scratch for each transaction.

- +Fosters trust with clients by presenting charges in a clear, professional manner.

- +Facilitates faster payments by including straightforward payment instructions and terms.

Cons

- -May require customization to fully meet specific business needs or industry standards.

- -Could lack unique features that specialized software offers, such as automatic reminders for overdue payments.

- -Relies on manual updating of invoice numbers and records, increasing the risk of discrepancies.

Common Uses

- Billing clients for products sold or services rendered.

- Requesting advance payments or deposits for work agreed upon.

- Documenting completed transactions as part of financial record-keeping.

- Providing detailed breakdowns of charges for projects involving multiple stages or components.

- Facilitating end-of-month accounting procedures by summarizing sales or services.

- Sending periodic invoices for ongoing contracts or retainer agreements.

Frequently Asked Questions

Invoice Generator

Do you have a question about an Invoice Template?

Example questions:

About this document

An invoice is a document from a seller to a buyer that details goods or services provided, costs, and payment terms, serving as both a payment request and a transaction record.

This document is designed to comply with the laws of all 50 states.

Related Documents

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!