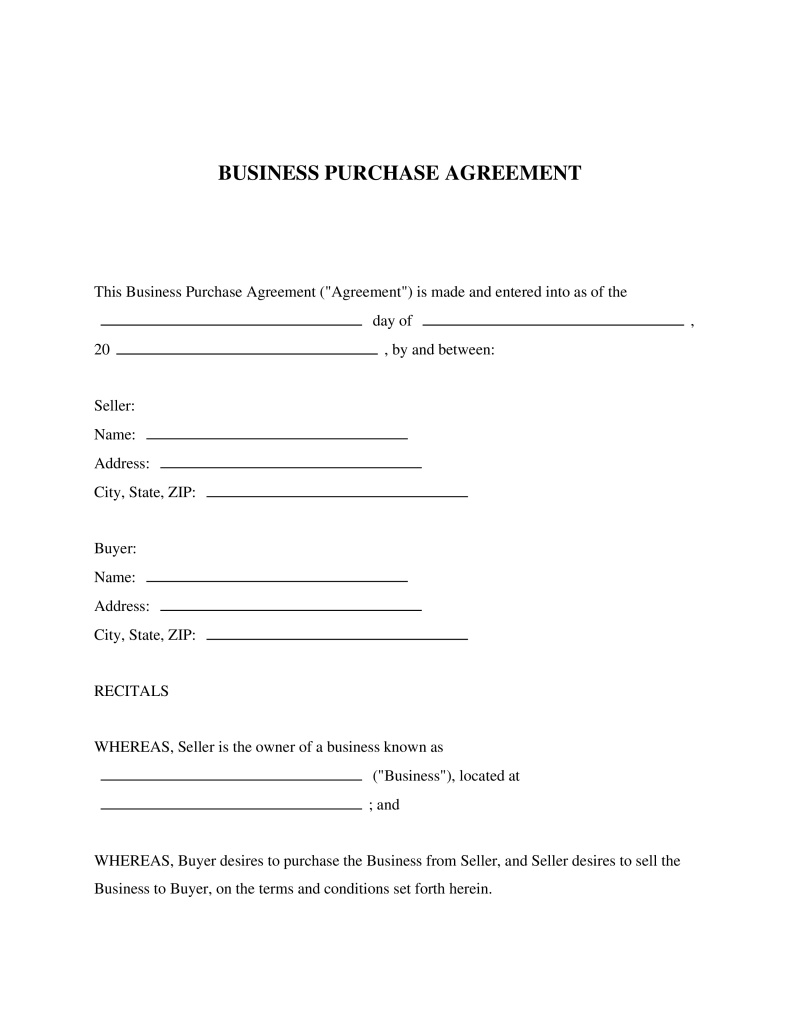

A Business Purchase Agreement outlines the terms for buying a business, detailing price, assets, liabilities, and responsibilities of both parties.

Grantor Name

Enter the full legal name of the person or entity selling the business.

Table of Contents

What is a Business Purchase Agreement?

A Business Purchase Agreement is a legally binding document that outlines the terms and conditions under which one party agrees to purchase the assets or shares of a business from another. This comprehensive contract ensures that both buyer and seller are clear on the specifics of the transaction, including price, assets to be transferred, liabilities assumed, and any contingencies that must be met before the sale can be finalized. Entrepreneurs looking to buy or sell a business find this agreement indispensable for protecting their interests and providing a clear roadmap of the transaction process. By meticulously detailing each party’s rights and obligations, it mitigates risks and facilitates a smoother transfer of ownership.

Key Features

Important Provisions

- Definition of Assets: A precise inventory of what is being bought or sold, whether it's physical property, intellectual property, stock in trade, or customer lists.

- Payment Terms: Detailed conditions under which payment will be made, including any escrow requirements or hold-back provisions for contingent liabilities.

- Representations and Warranties: Statements by both parties about the status and condition of the business that serve as assurances about what is being bought or sold.

- Confidentiality: Clauses that bind both parties to secrecy regarding sensitive information disclosed during negotiations.

- Dispute Resolution: Provisions specifying how disagreements over the interpretation or execution of the agreement will be resolved.

Pros and Cons

Pros

- +Reduces uncertainty by clearly defining each aspect of the sale, ensuring both parties have aligned expectations.

- +Legally protects interests by specifying recourse in the event of misrepresentation or breach of agreement.

- +Facilitates smoother negotiations by providing a structured format for discussing terms.

- +Helps in faster closing of deals by outlining agreed upon timelines for due diligence, financing approval, and other key milestones.

- +Can potentially save time and reduce legal costs by serving as a comprehensive template that covers most aspects of the purchase process.

Cons

- -May require adjustments or additions to address specific legal requirements or unique aspects of the business being sold.

- -Without proper legal review, parties may inadvertently agree to terms that are not in their best interest or fail to include necessary protections.

- -The complexity of the document could be daunting for those unfamiliar with legal terminology or business transactions.

Common Uses

- Buying or selling small to medium-sized businesses across various industries.

- Transferring ownership of specific business assets while keeping other parts of the business operational under the original owner.

- Facilitating mergers where one company purchases another to integrate their operations.

- Acquiring a competitor to expand market share or enter new markets.

- Selling a portion of a business for strategic realignment or raising capital.

- Transitioning ownership within family-owned businesses for succession planning purposes.

Frequently Asked Questions

Do you have a question about a Business Purchase Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!