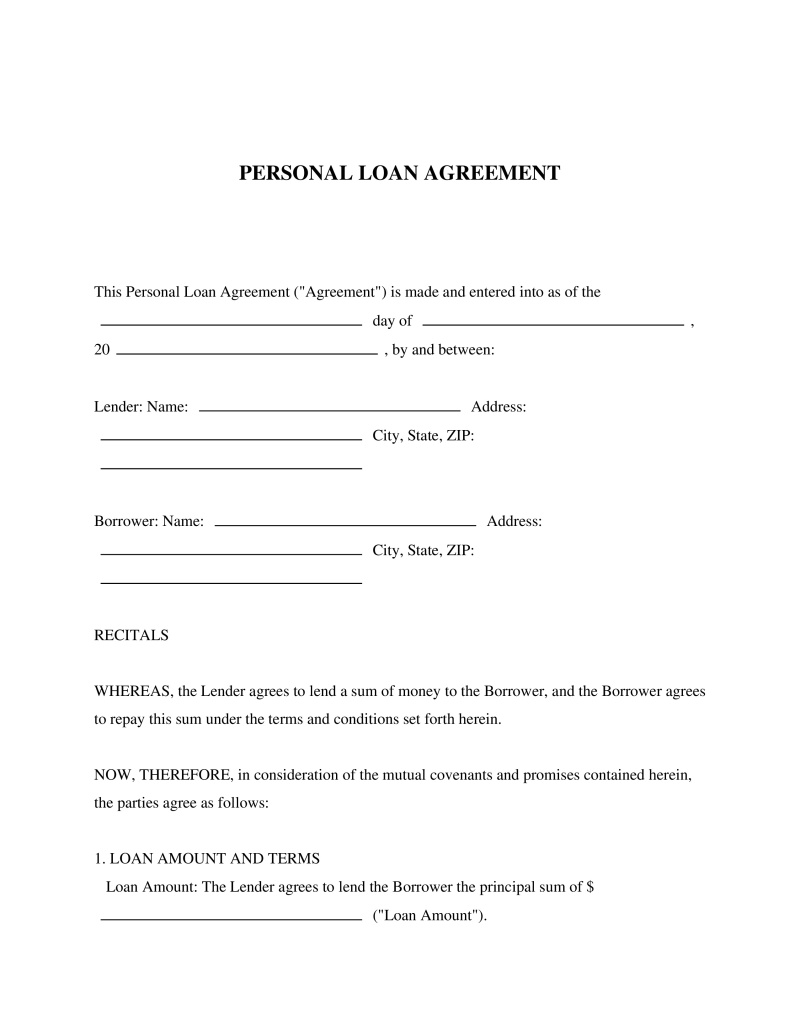

What is a Personal Loan Agreement?

A personal loan agreement template is a legal document that outlines the terms and conditions of a loan between two individuals. It specifies the amount of money borrowed, the interest rate, the repayment schedule, and other important details. This document is crucial in ensuring that both parties understand their responsibilities and rights in the context of the loan. The personal loan agreement template not only provides clarity and understanding but also serves as legal evidence in case of any disputes or misunderstandings.

Common Situations Requiring a Personal Loan Agreement

A personal loan agreement template is typically used when you're lending or borrowing money from a friend, family member, or private lender. Some common scenarios include:

- Helping a friend or family member with financial difficulties.

- Providing a loan to start a business.

- Financing a large purchase such as a vehicle or property.

Who Benefits From a Personal Loan Agreement?

Both the borrower and the lender benefit from a personal loan agreement template. It helps the lender by clearly stating the terms under which the money is lent, including the repayment schedule and interest rates. The borrower, on the other hand, can use the document to ensure they understand their obligations and avoid potential legal problems.

Legal Protection Offered by Personal Loan Agreement

This personal loan contract serves as a legal binding agreement between the two parties involved. It can protect the lender by providing a legal course of action if the borrower fails to repay the loan as agreed. For the borrower, it safeguards against unfair practices and ensures that the terms of the loan are clearly defined and understood.

Examples of Personal Loan Agreement Use Cases

- A parent lends their child money to purchase their first car. A personal loan agreement template is used to outline the repayment schedule and interest rate.

- An entrepreneur borrows money from a friend to start a business. They use a sample note payable agreement to clearly define the terms of the loan.

Frequently Asked Questions

About this document

A Personal Loan Agreement is a legal document that outlines the terms of a loan between individuals or businesses, including repayment, interest, and collateral, to ensure clarity and protect both parties involved.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!